virginia electric vehicle tax credit 2020

The annual highway use fee will be updated yearly on July 1. Restaurants In Matthews Nc That Deliver.

Elon Musk S And Tesla S Cozy Government Relationships Gets Tested By Biden Administration The Washington Post

Income Tax Rate Indonesia.

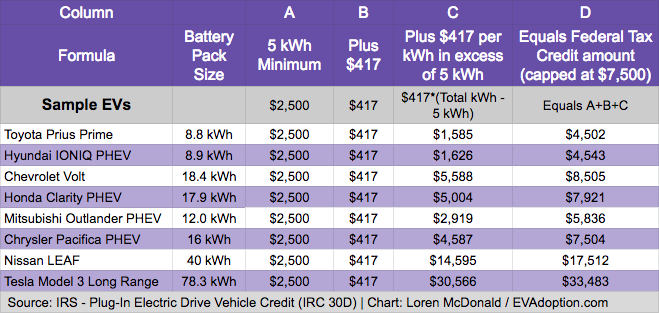

. Reference House Bill 717 2020 Electric Vehicle EV Charging Station Policies for Associations. Some hybrid electric vehicles have smaller batteries and dont quality for the maximum tax credit amount. General Motors vehicles purchased after 3312020 are not eligible for these tax credits.

Carry forward any unused credits for 3 years. Charge Ahead rebate of 5000 for purchase or lease of a new or used electric vehicle with a base price under 50000 for eligible customers. Under the Bipartisan Budget Act of 2018 the renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a gradual step down in the credit value the same as those for solar energy systems.

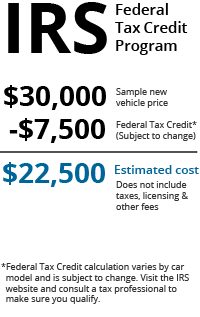

Download and complete the License Plate Application VSA 10 including the vehicle identification number VIN and title number. This credit may range from 2500 to 7500 and is intended to make it more affordable to manage the up-front costs of these vehicles. Standard Rebate of 2500 for purchase or lease of a new electric vehicle with a base price under 50000.

Review the credits below to see what you may be able to deduct from the tax you owe. The fee is included with registration fees and must be paid at the time of original registration and each year at renewal. All-electric vehicles EVs registered in Virginia are subject to a 8820 annual license tax at time of registration.

Manchin told Automotive News during an event in West Virginia that the EV tax credit provision. A bill proposed in mid-January by Virginia House Delegate David A. Soldier For Life Fort Campbell.

Federal Internal Revenue Service Savings. The credit is also transferrable. The federal ev tax credit may go up to 12500 ev tax credit for new electric vehicles.

Local Virginia and Maryland Electric Vehicle Tax Credits and Rebates. 30 for systems placed in service by 12312019. The Virginia General Assembly approved HB 1979 which provides a 2500 rebate for the purchase of a new or used electric vehicle.

Urging his department to spend more money building more highways in West Virginia when talk turned to EV tax credits. If the purchaser of an EV has an income that doesnt exceed. An income tax credit equal to 1ȼ per gallon of fuel produced.

Friday May 13 2022. Check that your vehicle made the list of qualifying clean fuel vehicles. Reference Virginia Code581-2217 and 581-2249 Electric Vehicle EV Rebate Program Working Group.

For electric cars it is a flat 8820 fee. For more information see the Virginia DMV Electric Vehicleswebsite. However you should be.

Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500. Fuel-efficient gas vehicles will pay a. To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page.

Electric vehicles that get 200 or more miles of range would qualify for a 2000 rebate for new and 1000 for a used vehicle. In 2020 Lawmakers chose to pass a Highway Use Fee. How Much Is the EV Tax Credit.

Virginia Department of Taxation website. Opry Mills Breakfast Restaurants. In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability.

West Virginia has seen a slow electric vehicle adoption rate with just about 550 EVs bought between 2011 and 2016. Drive Electric Virginia is a project of. Vehicles that get less than 120 miles per charge qualify for 400 for a new vehicle and 200 for used.

Pursuant to 581-4003 of the Code of Virginia certain electric suppliers are required to pay a minimum tax rather than a corporate income tax for any taxable year their minimum tax liability is greater than their corporate income tax liabilityThe minimum tax would be equal to 145 of the electric. Virginia Ev Tax Credit 2020. If you take home a new PEV that meets certain requirements such as battery capacity overall vehicle weight and emission standards you can also receive a federal tax credit of up to 2500.

Theres good news on the local front on electric vehicle tax incentives and rebates in Virginia. Claim the credit against the following taxes administered by Virginia Tax. The amount of the tax credit ranges from 2500 to 7500 depending on the size of your battery.

26 for systems placed in service after. DMV Registration Work Center. The credit is also transferrable.

The maximum credit allowed is 5000 not to exceed your tax liability. Biodiesel Production Tax Credit. It gets paid when you register your car.

To begin the federal government is offering several tax incentives for drivers of EVs. Delivery Spanish Fork Restaurants. The state of Virginia is not the only sector willing to reward customers for the purchase of an EV as well as a Plug-In Hybrid PEV.

Solar and Energy Storage. Reid D-32nd would have granted a state-tax rebate of up to 3500. The credit amount will vary based on the capacity of the battery used to power the vehicle.

Reference Virginia Code 581-4391202 Agriculture and Forestry Biofuel Production Grants. Either fax your application to 804 367-6379 or mail it to. A vehicle that gets between 120 and 200 miles qualifies for 1500 for new and 750 for used.

Essex Ct Pizza Restaurants. 56 rows tax credits for heavy duty electric vehicles with 25000 in credit. An annual highway use fee will be assessed on each electric motor vehicle registered for highway use in Virginia.

Virginia electric vehicle tax credit 2020.

Electric Car Tax Credits What S Available Energysage

How Do Electric Car Tax Credits Work Kelley Blue Book

Latest On Tesla Ev Tax Credit March 2022

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

Electric Car Tax Credit What Is Form 8834 Turbotax Tax Tips Videos

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Rebates And Tax Credits For Electric Vehicle Charging Stations

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

Electric Vehicles Should Be A Win For American Workers Center For American Progress

Joe Manchin Says Ludicrous Electric Vehicle Tax Credit Not Needed Bloomberg

Electric Vehicle Buying Guide Kelley Blue Book

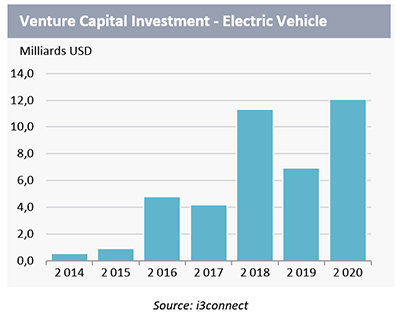

A Global Car Market On A Roller Coaster Ifpen

Current Ev Registrations In The Us How Does Your State Stack Up Electrek

Tesla S 7 500 Tax Credit Goes Poof But Buyers May Benefit Wired